main street small business tax credit ca

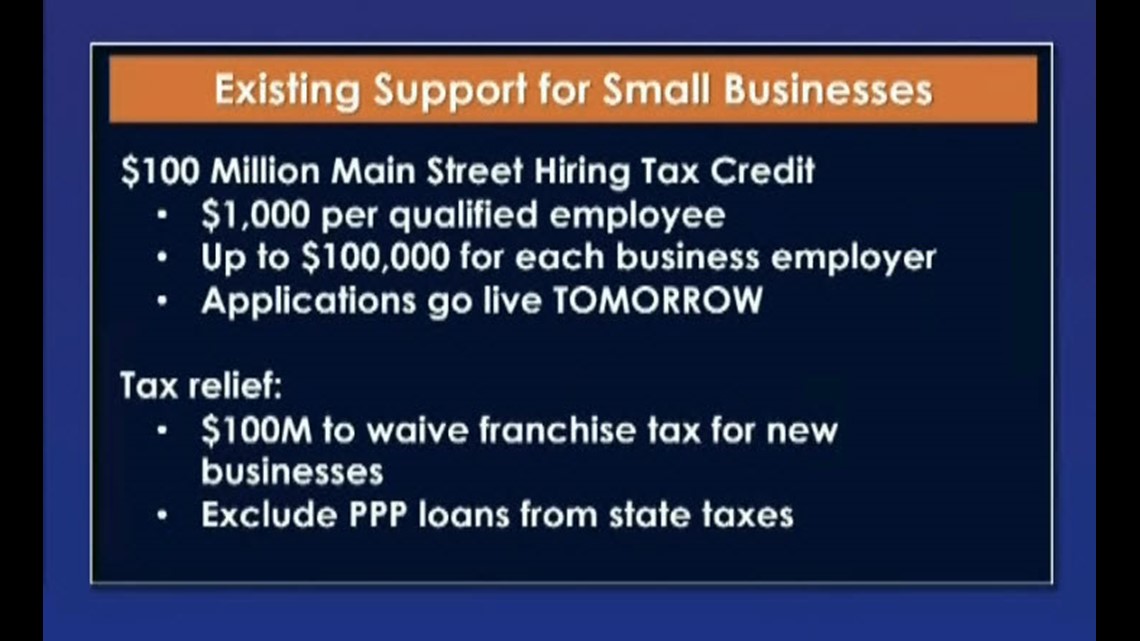

Funding for the Small Business Hiring Tax Credit program totals 100 million and is to be allocated to qualified California small business employers. Employers that have increased hiring since the base period April 1 2020 to June 30 2020.

2021 Main Street Small Business Tax Credit In California Heather

The Main Street Small Business Tax Credit is a bill that provides financial relief to qualified small businesses for the economic disruptions in 2020 and 2021 that caused massive.

. Each employer is limited to no more than 100000 of this credit. Welcome to the California. The amount of credit you may receive for the 2021 taxable year is reduced by the Main Street Small Business Tax.

Each employer is limited to no more than 150000 in credit. Based on the significant number of applications already received funding for the Main Street Micro Business Loan is fully subscribed. The amount of credit you may receive for the 2021 taxable year is reduced by the Main Street Small Business Tax.

You will be notified by the CDTFA within 30 days of your application as to whether a tentative credit reservation has been. A tentative credit reservation must be made. California Main Street Small Business Tax Credit II.

Based on the fact that the NJEDAs application fee is. First-come First-served by November 30 Marcum LLP Accountants and Advisors Marcum and Friedman Complete. The 2021 Main Street Small Business Tax Credit II is set to provide further financial relief to qualified small business employers.

The Main Street Small Business Tax Credit II may be used to offset income tax or sales tax by making an irrevocable election. The credit caps out at 100000 per employer. The Main Street Small Business Tax Credit applies only to California small businesses that meet the following criteria.

The California legislature authorized another round of funding for the Main Street Hiring Credit. How to claim File your original or amended income tax return. Experienced a net increase in qualified.

Each employer is limited to no more than 150000 in credit. 2021 Main Street Small Business Tax Credit II Reservation System The 2021 Main Street Small Business Tax Credit II reservation process is now closed. Include your Main Street Small Business Hiring Credit FTB.

The credit will allow those who qualify.

Small Business Tax Credit Reservation System Home

Business Licenses City Of La Puente

Los Angeles U S Small Business Administration

Mak Financial To Help Small Businesses That Are Climbing Back From The Financial Devastation Caused By Covid 19 California Is Providing Main Street Hiring Credit For The 2020 Tax Year Only We Re

Covid 19 Cares Act Relief Resources U S Travel Association

3 New Resources To Support California Businesses During Covid 19

Ca Offers Two Covid 19 Relief Programs San Leandro Next

How Small Business Is Claiming Billions In Cash Refunds From Irs

Tax Reform For Small Businesses Nfib

Main Street Small Business Tax Credit Incentives Eligibility

Tracy Stanhoff Adprotracy Twitter

Five Truths About How The Inflation Reduction Act Will Help Small Business And Working Families

Mainstreet Rise Main Association For Enterprise Opportunity

Small Business Tax Credits The Complete Guide Nerdwallet

Relief For Small California Businesses Cbs8 Com

Senator Shannon Grove On Twitter Earlier This Year I Supported Sb1447 To Bring Much Needed Help To Our Small Businesses Are You A Small Business Owner Check Out The Fact Sheet Below

First Come First Served By November 30 California Hiring Tax Credit Ii Windes